The strong inflow pushed the asset base of equity Mutual Funds by more than 6 per cent. The investors are increasingly becoming mature about market volatility.

The strong inflow pushed the asset base of equity Mutual Funds by more than 6 per cent. The investors are increasingly becoming mature about market volatility.

- The Economic Times

In spite of a heavy drop in mid-cap, small-cap, the investment in equity continued.

In spite of a heavy drop in mid-cap, small-cap, the investment in equity continued.

- Daily Hunt

Balanced Funds shrink by 72% in five months, 10% dividend distribution tax to blame.

Balanced Funds shrink by 72% in five months, 10% dividend distribution tax to blame.

- Business Standard

If you could decipher the highlighted terms or any information for yourself from the above headlines, you are surely an investment aware and investor educated person. But, what if it sounds Archi or Mandarin or Tuyuca, to you? Homophonous to some of the weirdest languages of our world. Will you be curious about it or act ignant? For your genuine curiosity, there is Vyapyaar.

Vyap-yaar is an investment education platform which simplifies any financial jargons and investment concepts for any newbie, any inquisitive investor, who is curious, interested and wants to know more about the world of trading but is often scared or misled due to misinformation or unawareness.

Design an investment research & planning solution that simplifies complicated financial terminology and concepts used to evaluate stocks, mutual funds and other personal investment options so that users are comfortable and confident of making their own investment choices and decisions.

The timeline for a solution was 4 days.

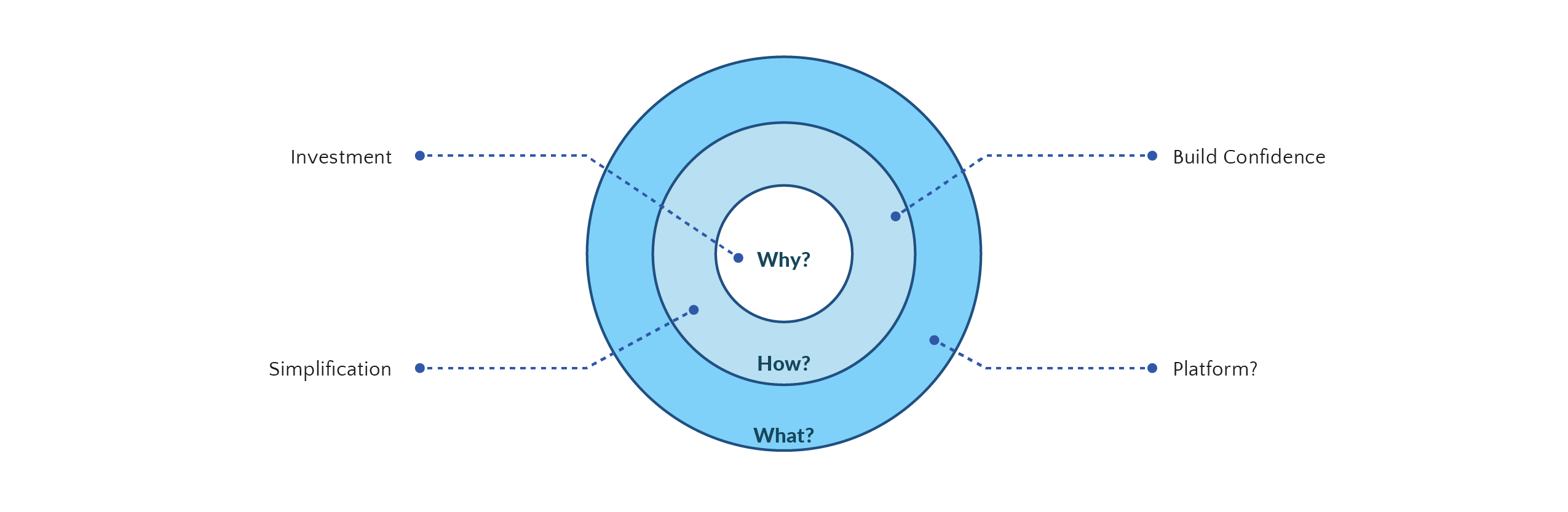

To start off, I mapped the problem statement into Simon Sinek’s Golden Circle of Why? How? What? which helped me frame my design process, research methodology and approach to the possible solution. I began with the “Why” phase asking a very basic question: “Why investment is important?”

Understanding the Domain

Secondary Research

Compete Market Study

Build Questionnaire

Primary Research

Gathering Insights

Framing Opportunity

Structuring Information

Expert Reviews

Creating Persona

Brainstorming

Concepts & Flows

Information Architecture

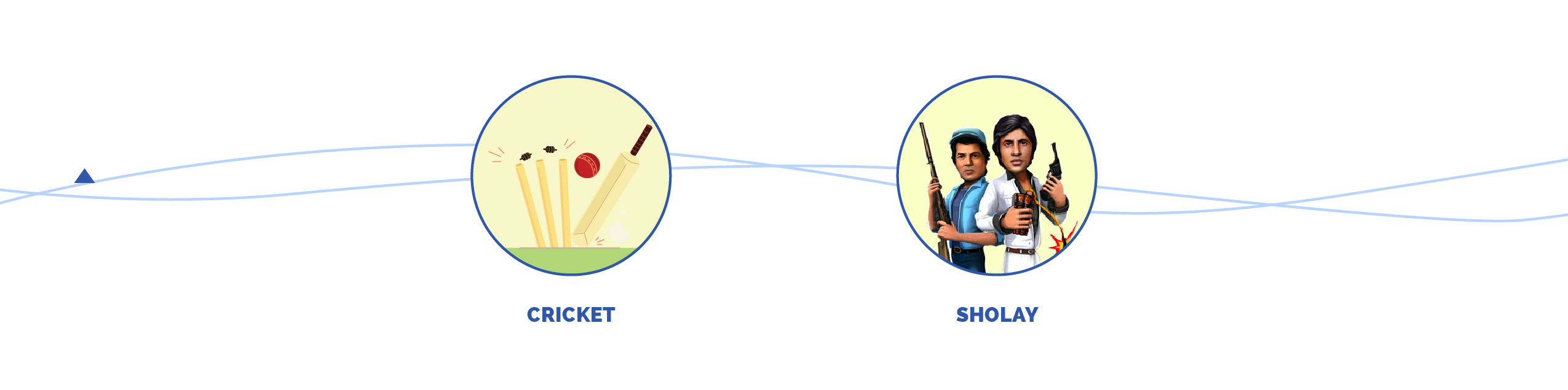

Wireframes

Build Scenario

Create Hi-Fi Mockups

Visual Design

Design Interactions

More often than not, we come across such news about stock market crashes, mutual funds, investments in equities and shares, but like most times, we are left clueless at the end. Not necessarily because we are impassive, but mostly because we are oblivious to these terminologies which literally makes little sense. We eventually end up developing an apathy and indifference to such sources of income.

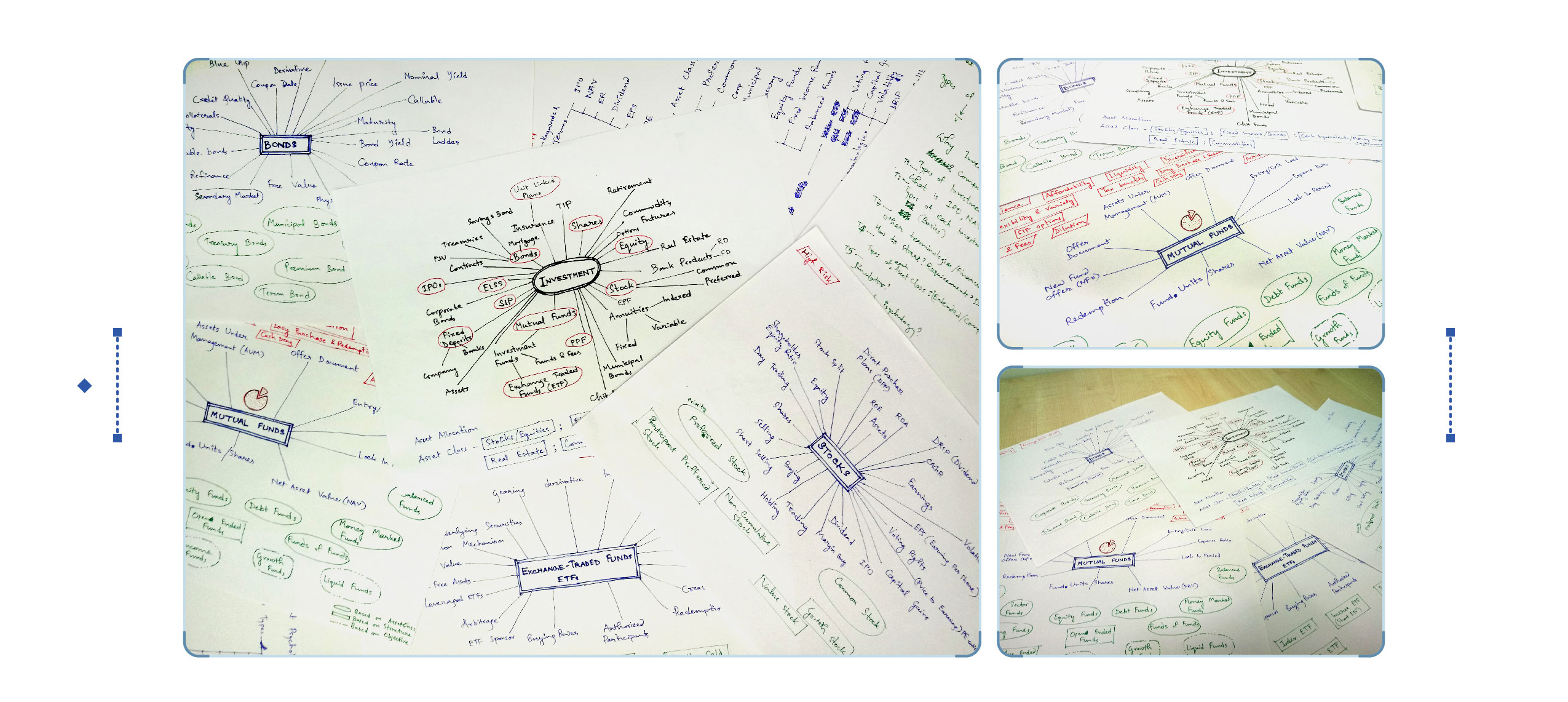

Being a lay-man myself, understanding the domain itself was the biggest challenge I faced. I started researching through various websites, blogs and e-books to understand more about investments. Having previously invested in fixed deposits and recurring deposits, I quickly realized I was at the bottom of the investment industry pile and was diving into a plethora of stocks, bonds, funds, shares, equities, a very different, exciting and interesting world.

I started understanding various types of investments, the various associated financial jargons, the types of each asset class, the various advantages, disadvantages of the popular investment types and its stakeholders.

The most popular investment types were listed and studied in details. Considering the vastness and complexity of those topics, I could categorize it as BASIC and ADVANCED but it was important to understand how much is ENOUGH to begin.

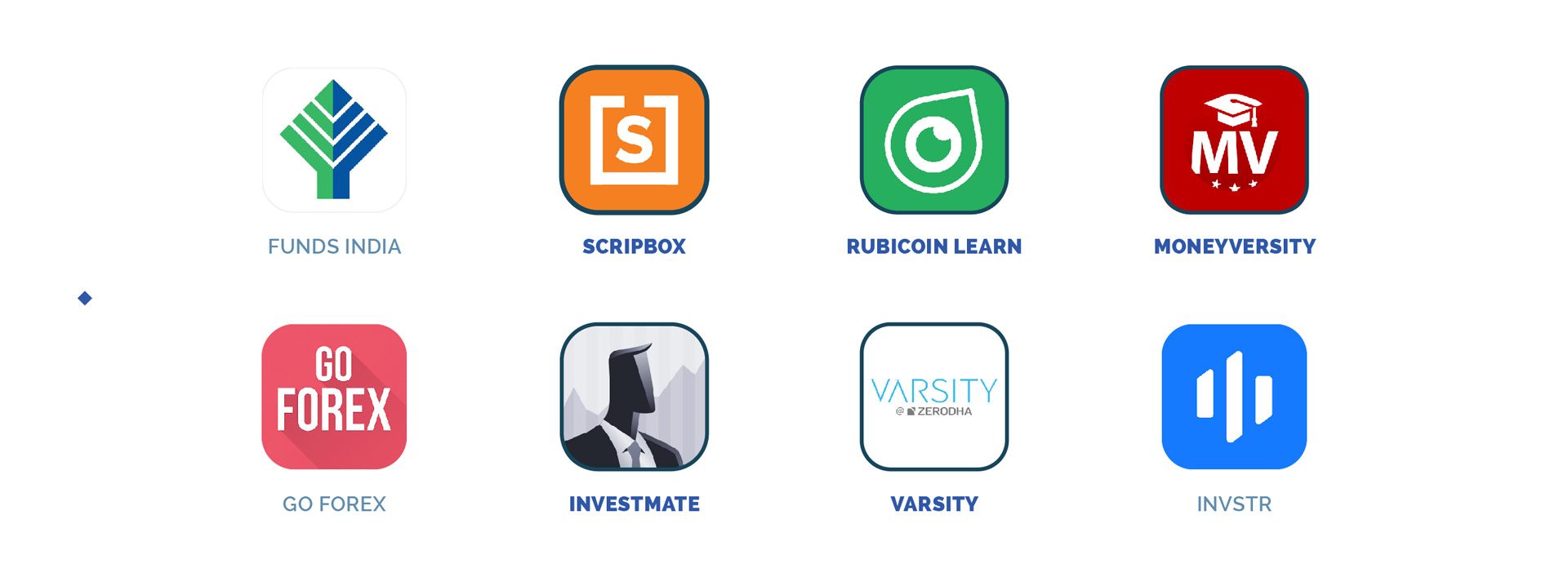

As a part of Market Study, I went exploring various platforms which does a similar job, i.e., help any amateur investor/beginner learn about investments and help them take confident decisions before investing. While the highlighted 5 platforms are doing a similar job of helping an amateur understand the investment industry, with unique structures, the technicalities and complicacies of financial domain were still faintly addressed.

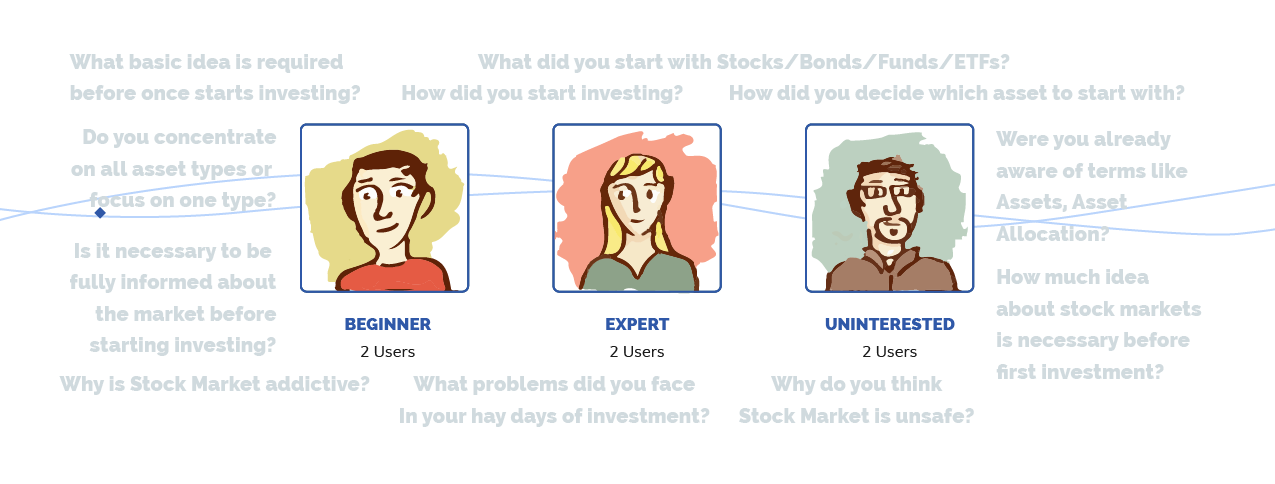

During Primary Research, I reached out to a few users, basically grouped as “Beginner”, “Expert” and “Uninterested”. I framed a few questions for the interviews with the intention to understand what drives/drove their decisions about investing/not investing.

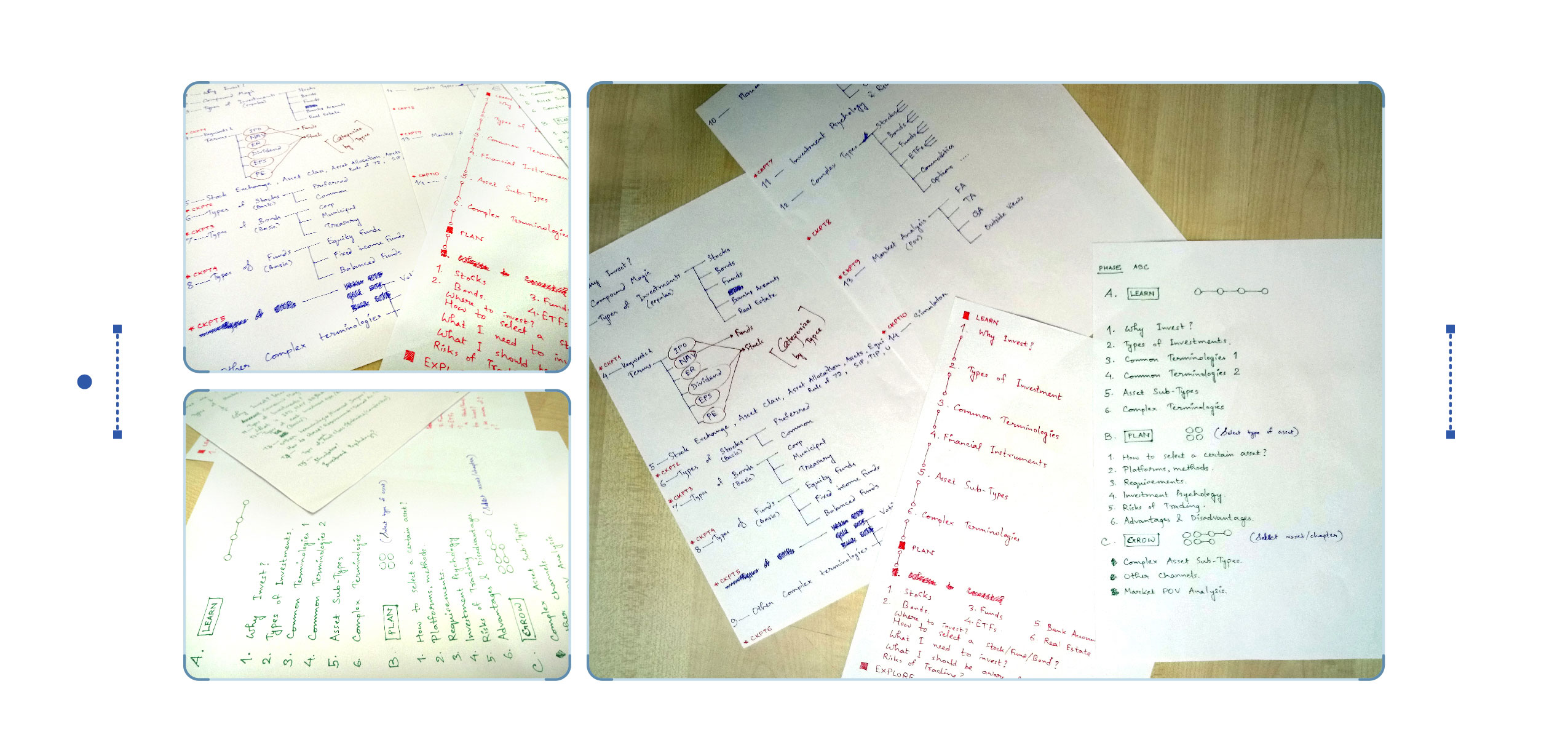

I listed down the various approaches, problems, confusions, those users faced in their early days. Also, it helped me answer the question “How much is ENOUGH to know to start investing?”. Based on my understanding, I iterated on a few structures, got it reviewed by 2 experienced investors and finalized an INFORMATION STRUCTURE for the platform which would address the purpose of investment education.

The major challenge in this phase was structuring the investment education in an easy, comfortable and consumable format. The intention was to create a valid structure which would keep the user interested and also equip him and develop his confidence about starting to invest after a certain stage and not wait till being an expert, as one of Warren Buffet’s top tip is to BEGIN AS EARLY AS POSSIBLE.

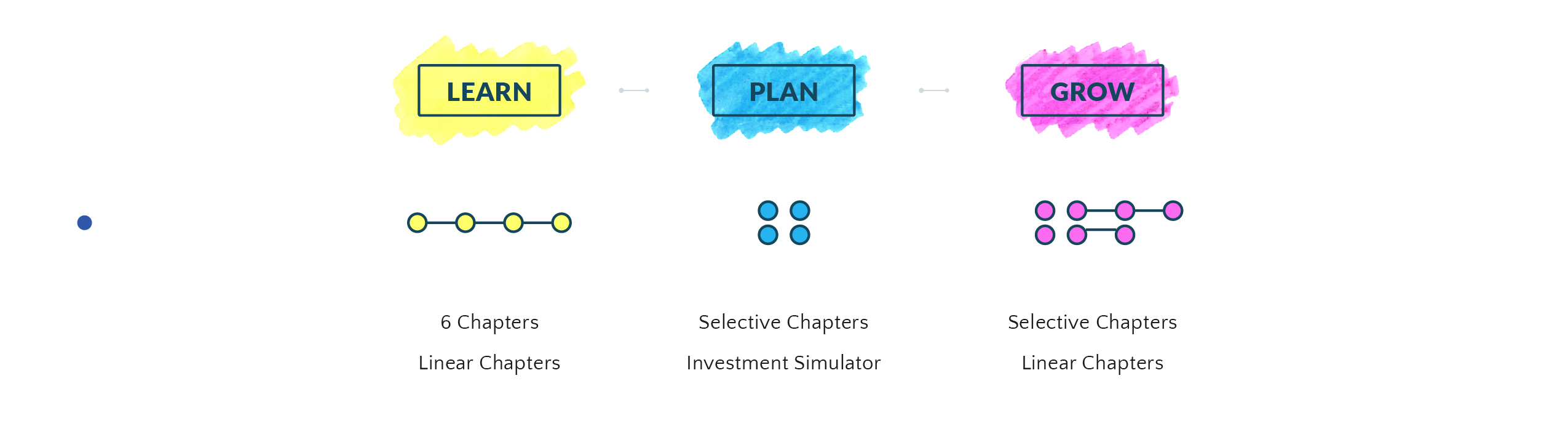

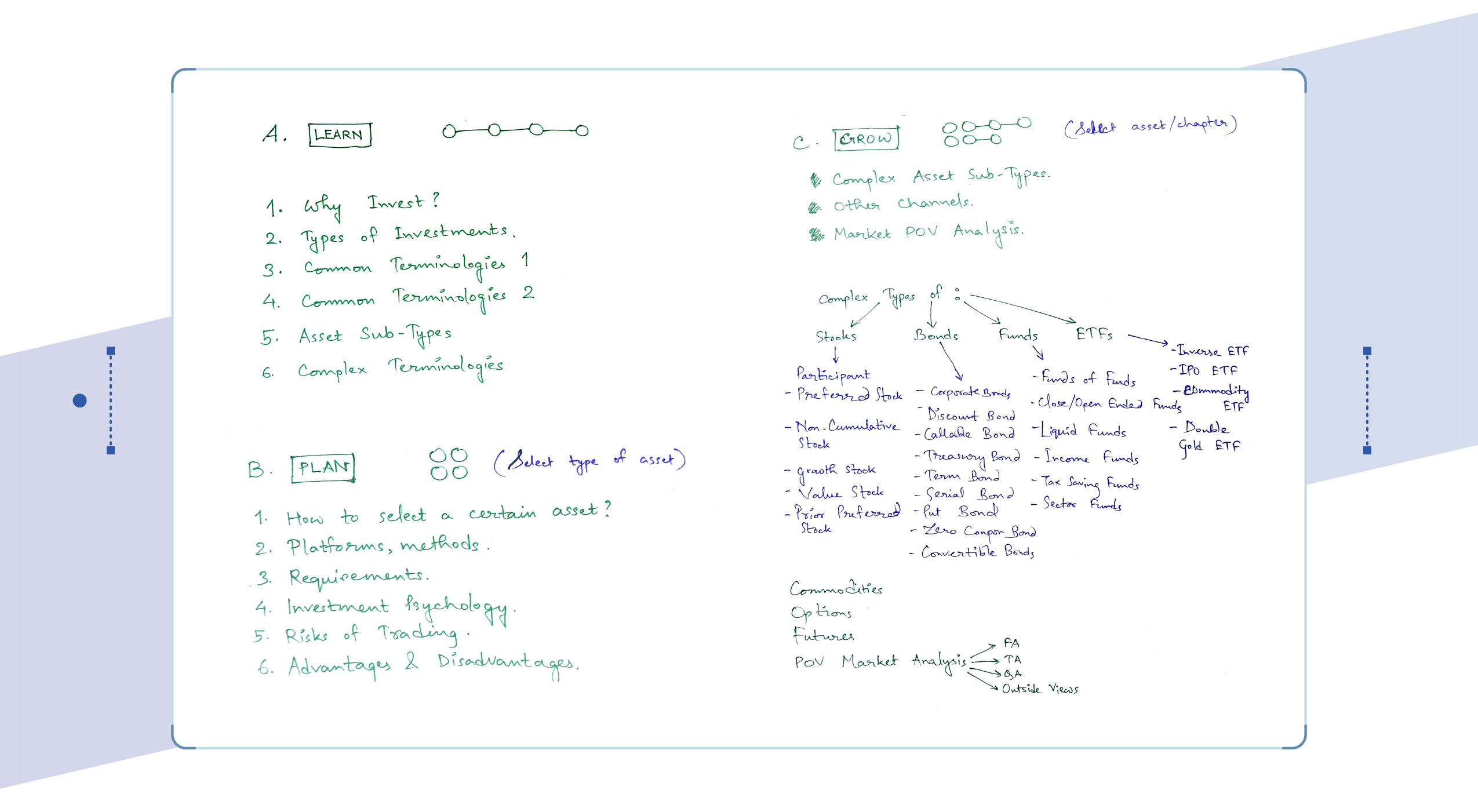

My investment education program was structured into 3 phases: LEARN, PLAN & GROW with various modules within. While LEARN phase addressed BASIC education, the PLAN phase equips him to begin.

The LEARN phase is the BASIC level comprising of linear chapters based on basic understanding of various financial and investment terminologies, importance of investments, its general types, etc.

The PLAN phase, i.e., the INTERMEDIATE level, has selective chapters. This is when the user is educated enough to decide on what to invest into and start planning specifically for that type. This phase has a goal based investment simulator which helps you invest and understand returns, hands on. Checkpoints are designed to keep the user up-to-date with whatever s/he had already learnt.

The GROW phase is about the ADVANCED level investment education. It comprises of both linear and selective chapters. It basically addresses the various complexities of the Stock Market in more details gradually educating you towards an expert investor.

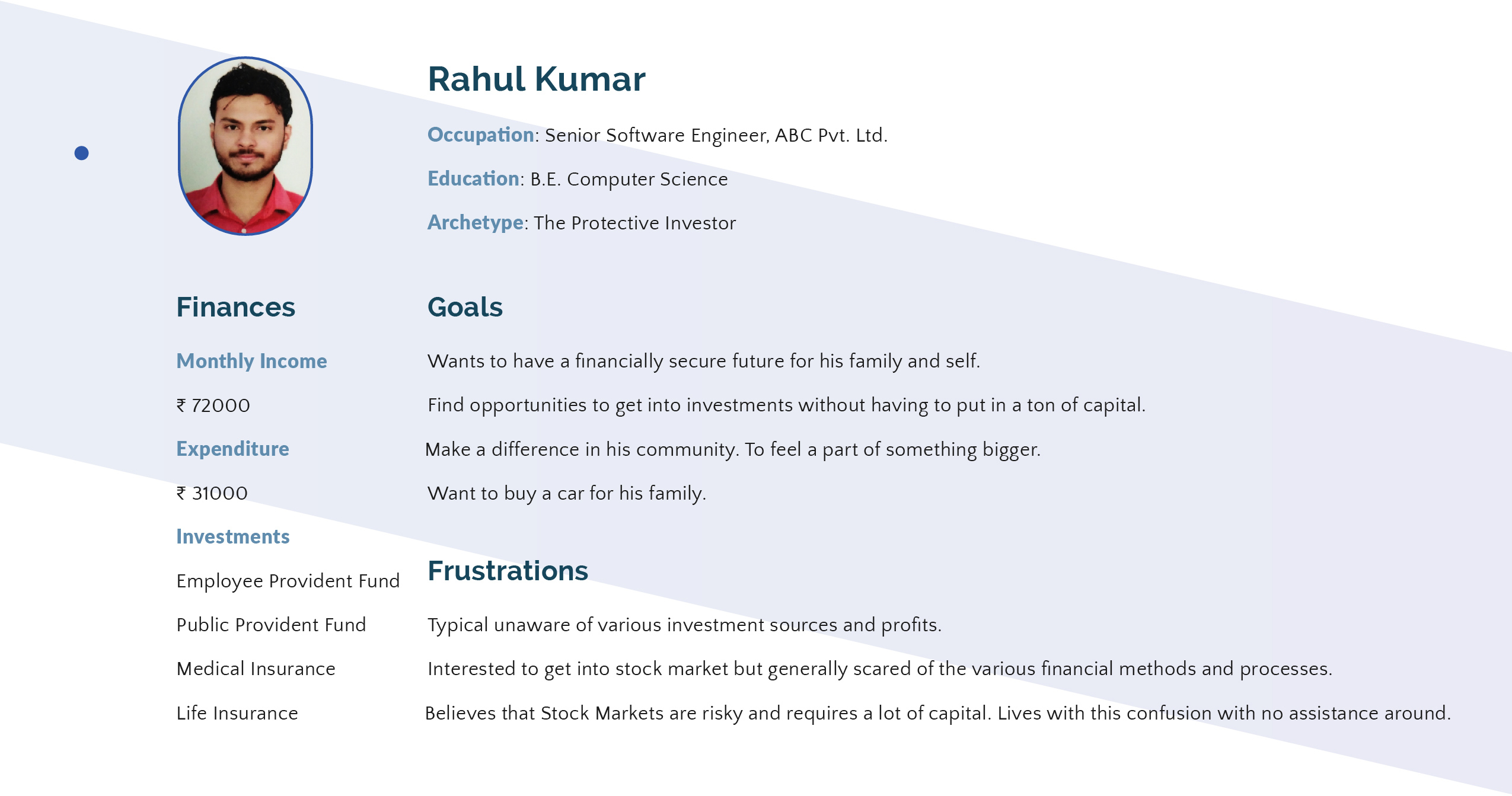

At the end of research and analysis, I could define my User Persona for this problem.

While the STRUCTURE was in place, the intention to make the content more comfortable and consumable was still unaddressed. While addressing this aspect, I stumbled upon an interesting concept called “INVESTMENT METAPHORS”.

In Benjamin Graham’s classic The Intelligent Investor, the author encourages investors to think of the stock market as a manic-depressive person whose erratic behavior changes daily. This specialized agent metaphor helps readers intuitively grasp market volatility and the opportunities it presents.

In Benjamin Graham’s classic The Intelligent Investor, the author encourages investors to think of the stock market as a manic-depressive person whose erratic behavior changes daily. This specialized agent metaphor helps readers intuitively grasp market volatility and the opportunities it presents.

Professor Michael Morris, Psychology Department of Columbia University

Two common types of metaphors are used in stock market commentary: agent metaphors, which describe price trajectories as volitional actions (such as “the Dow fought its way upward”) and object metaphors, which describe price changes as movements of inanimate objects (“the NASDAQ dropped off a cliff”).

Two common types of metaphors are used in stock market commentary: agent metaphors, which describe price trajectories as volitional actions (such as “the Dow fought its way upward”) and object metaphors, which describe price changes as movements of inanimate objects (“the NASDAQ dropped off a cliff”).

Professor Michael Morris, Psychology Department of Columbia University

Co-Researchers - Oliver Sheldon of Cornell University and Maia Young, University of California

Researcher - Professor Daniel Ames

I used the power of metaphors and ideated on a few options which could be used to understand complex financial jargons and other fundamentals of investment industry. I explored on a few Indian contextual metaphors like an Agent Metaphor as SHOLAY or an Object Metaphor as CRICKET, with the potential to explore various other metaphors across genres, as per one’s liking.

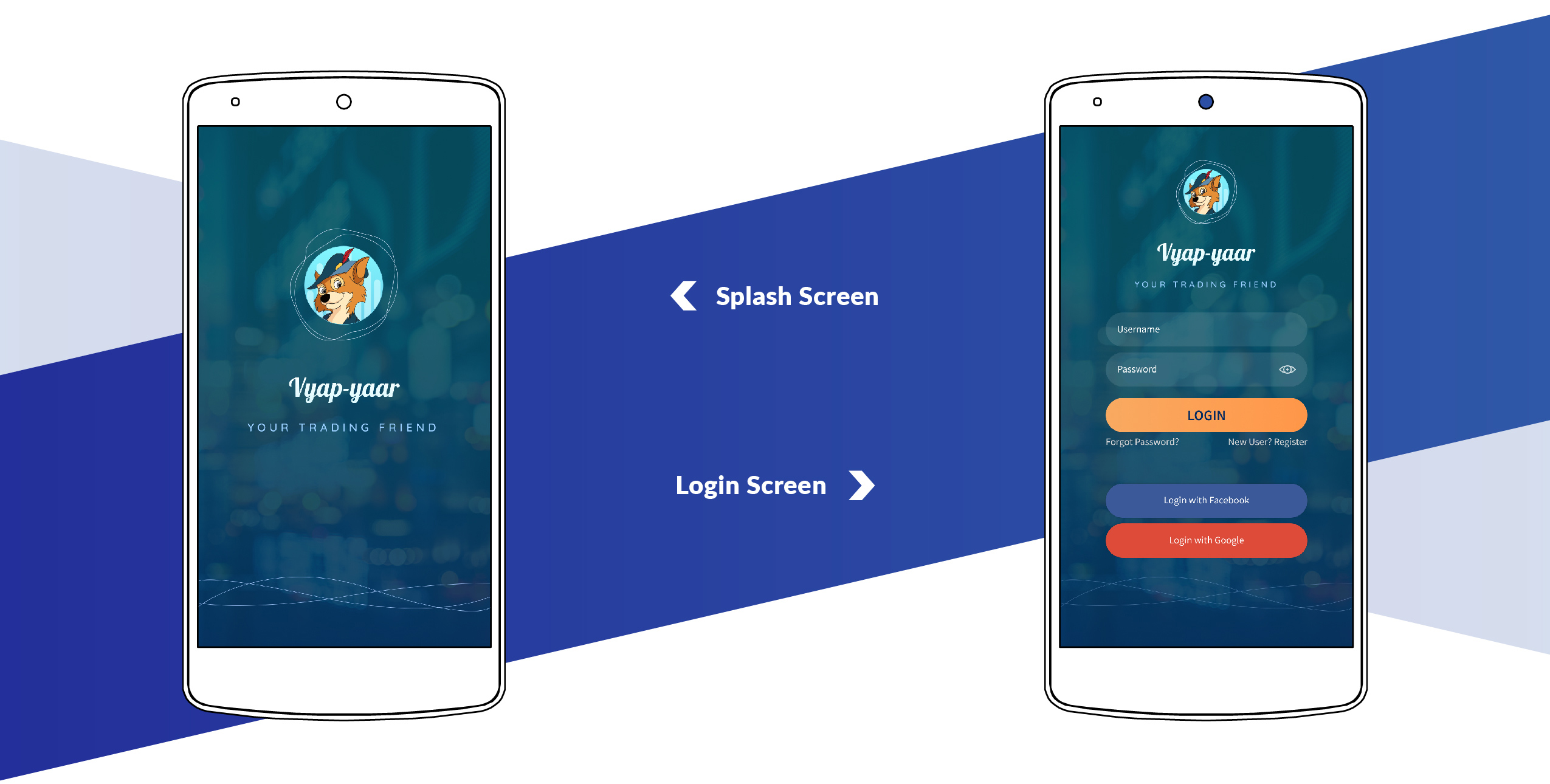

Also the idea was to introduce the concept of a FRIEND, basically an intelligent bot, which would help the user at anytime with queries or doubts, conversing through voice NLP and also chatting with the user in need to provide a personal comfort. The conversational bot (CBOT) was named as Robin, inspired from the Disney fictional character Robinhood, known as a good and generous being at heart who always helps the needy. The platform was titled as Vyap-yaar - Your Trading Friend (yaar), homophonous to Vyapaar, meaning trade/business in Hindi.

With the current trend of mobile-first, the intention for this mobile application was to keep the screens minimalistic so that users are not bombarded with information; information which is already suffering from apathetic vulnerability for my target users.

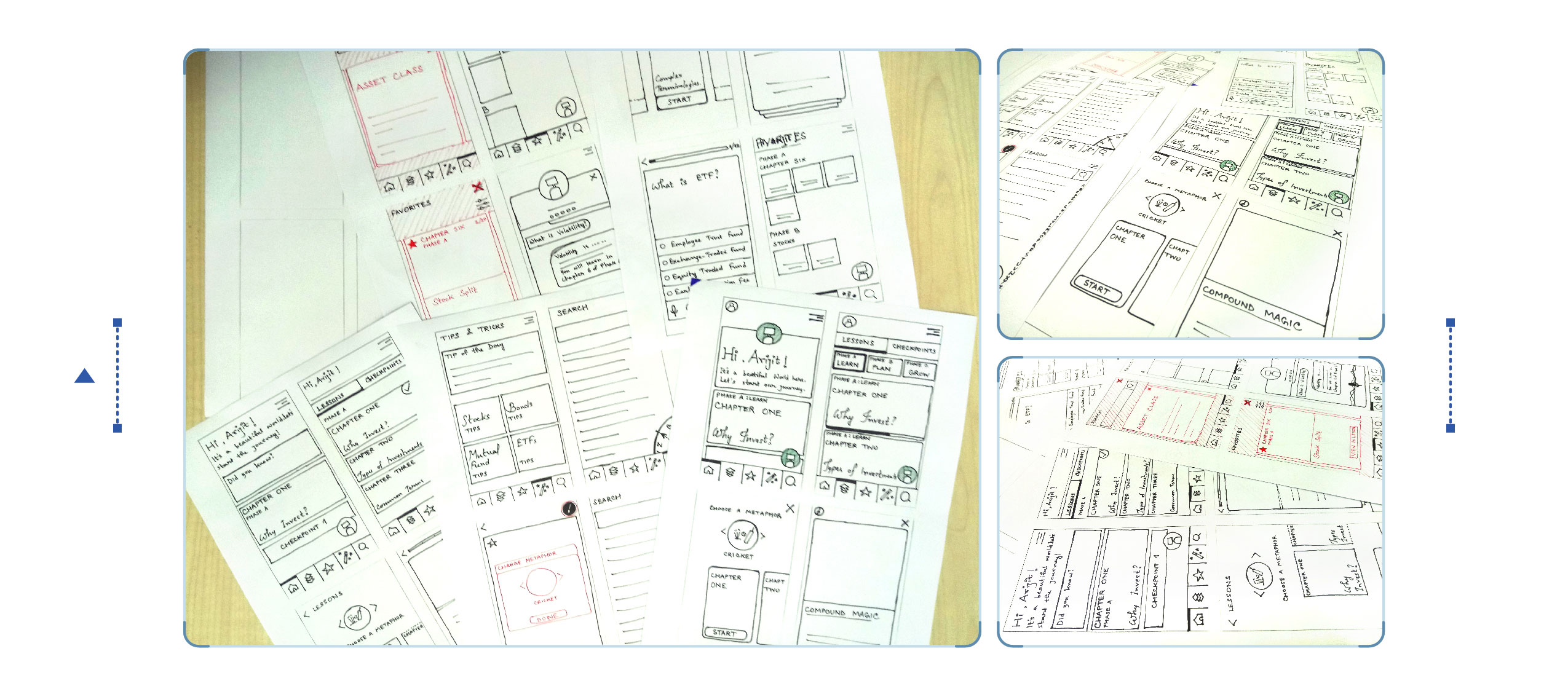

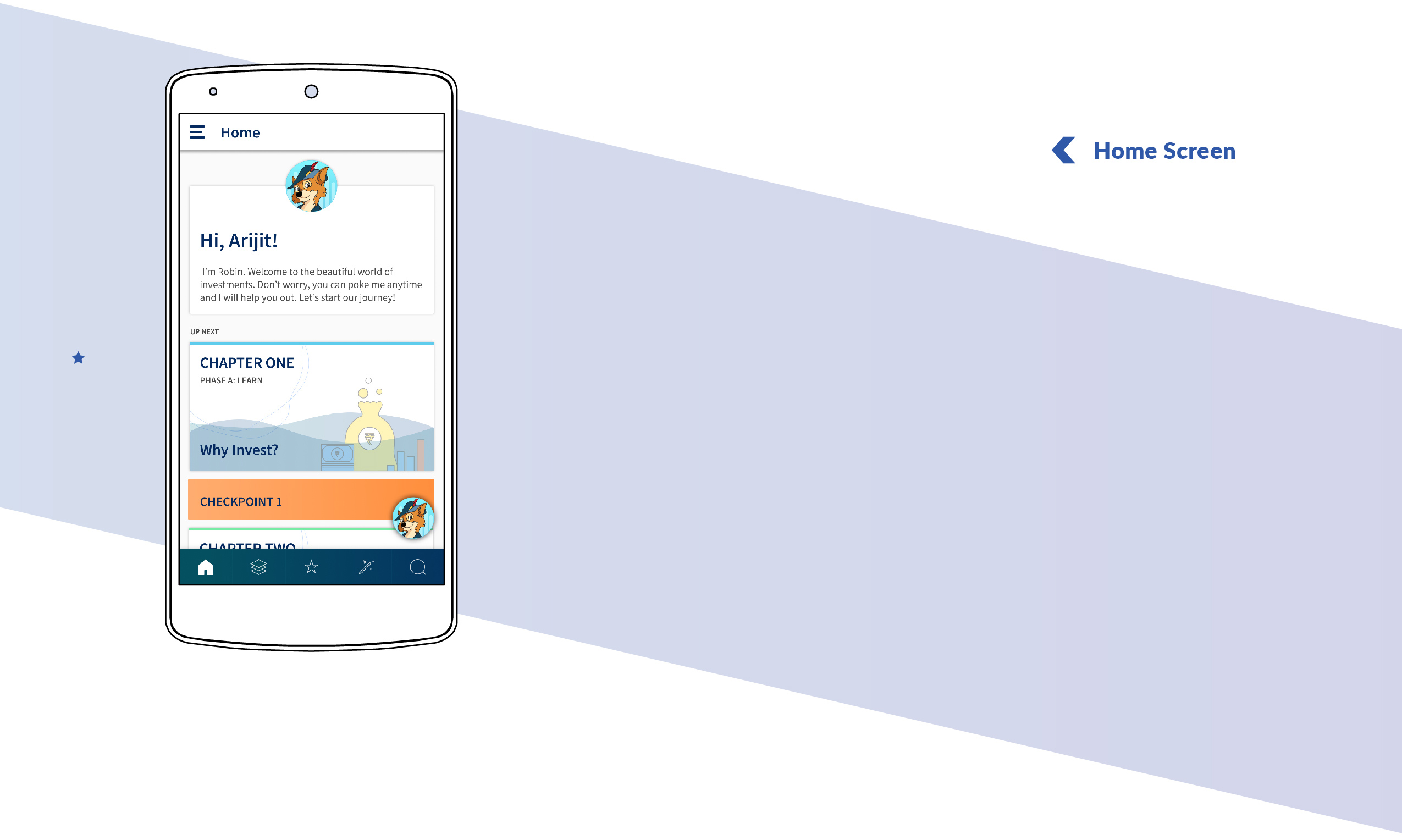

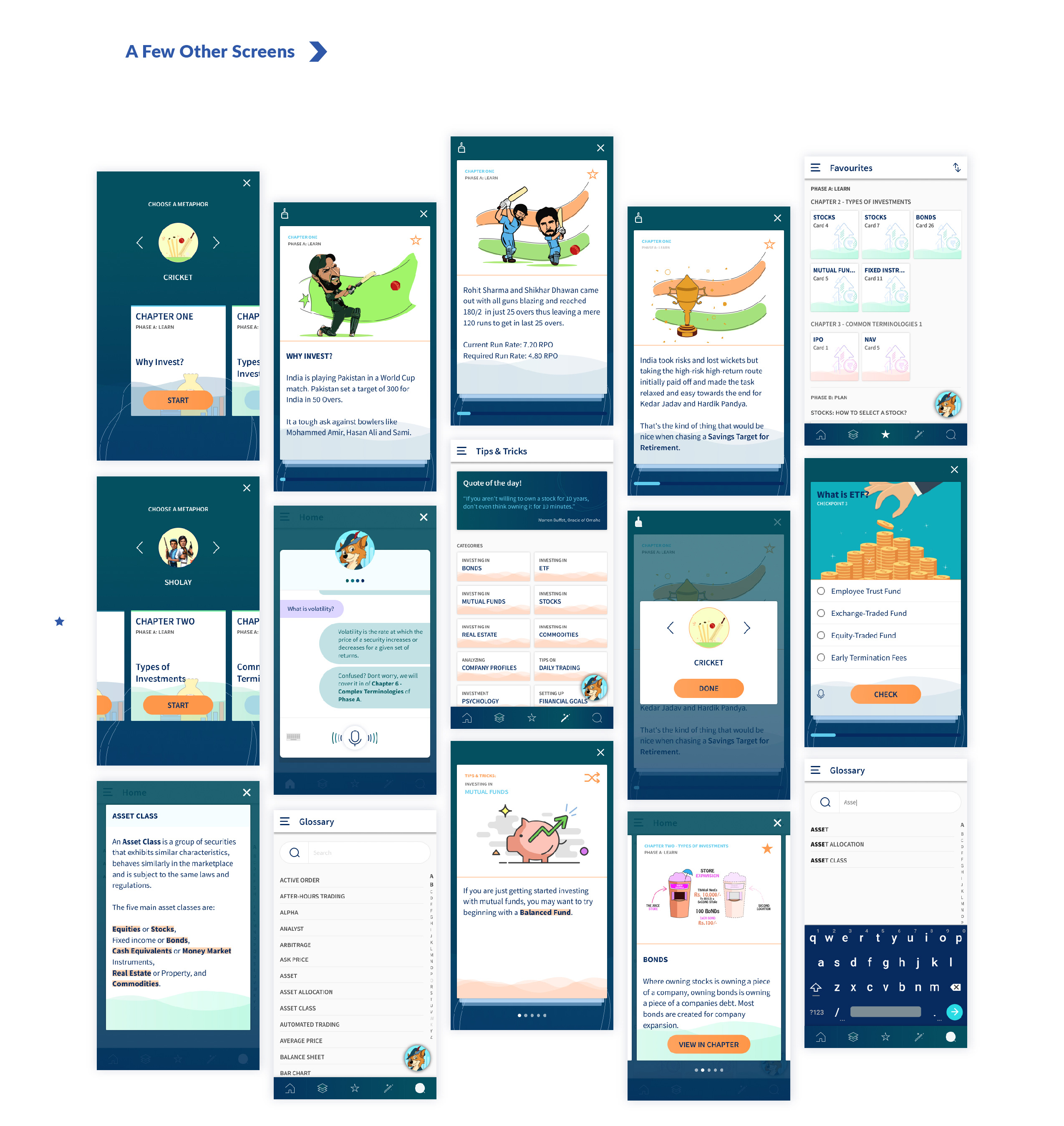

Home, Store, Favourite, Tips & Tricks, and Glossary formed the 5 pivots of the application, while the AI conversational bot Robin was interconnected to all these pivots, communicating with all services.

In this phase, I created the Hi-Fi screen versions of the application and represented a scenario of Understanding Stocks through a metaphor in Vyapyaar. I worked in the interface design tool Figma for creating the mockups with an eye on Android Material Design Guidelines.

In the home screen, Robbin greets the user with a positive message thus ensuring a relaxed mood.

The second section “Up Next” shows the next task (Chapter One, here) to be done. The blue bar on top of the card indicates chapter completion percentage.

This section gives the user the opportunity to straight away jump to the next checkpoint if the user is confident enough to skip a few chapters. Robin is the floating action button.

This plaform is structured across 5 pivots which forms the basic navigation bar of the application.

The user can talk to Robin from any screen and ask for help through voice NLP. Like if you ask “What is Volatility?”, it would respond with a definition but in case the chapter is not yet covered, it would calm you down assuring that it will be covered later and you need not panic about it, you are going great, making it more conversational and natural.

Alternatively, the user can use the keyboard to type and chat with Robin.

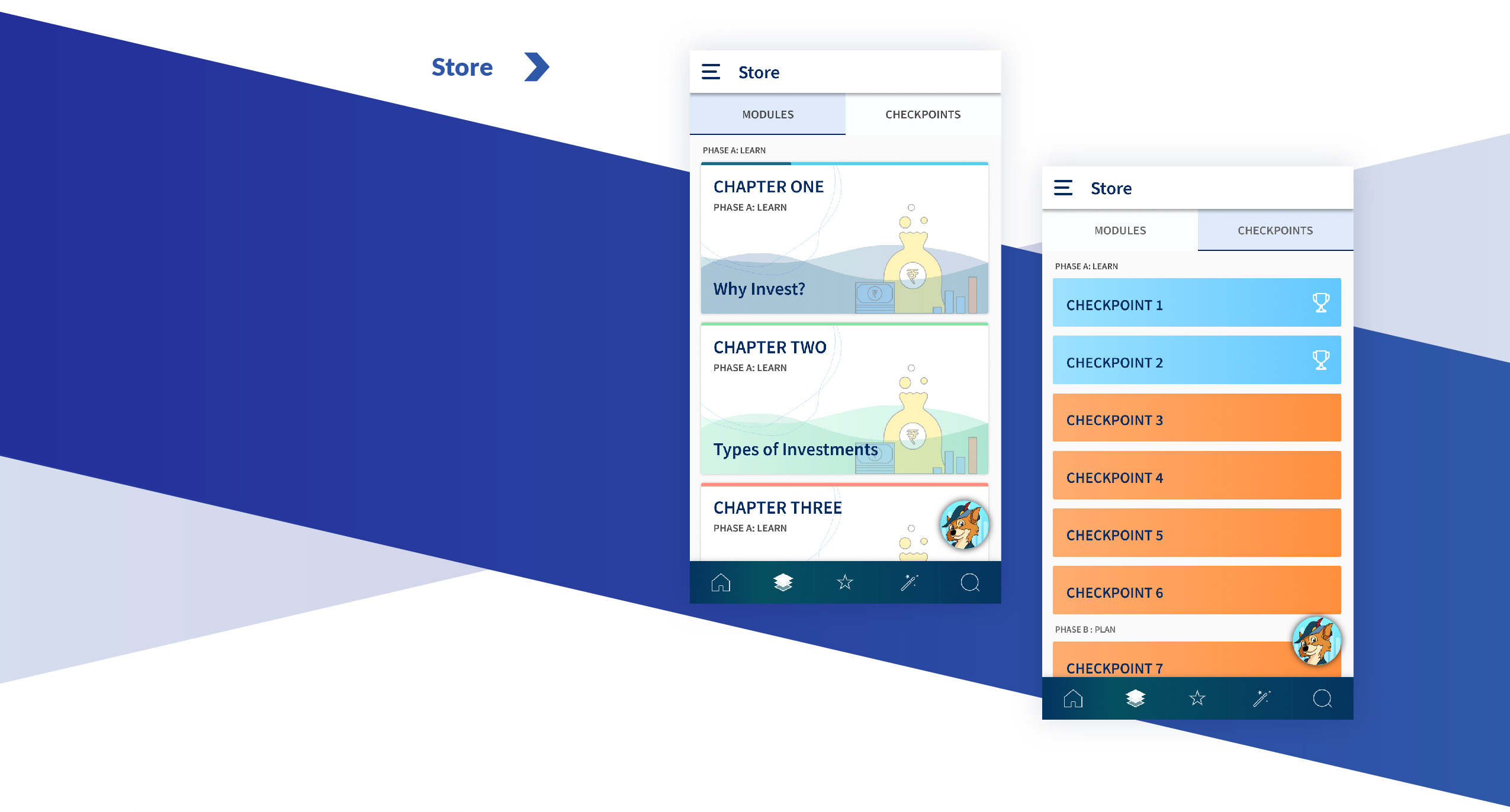

The store comprises of all phases, modules, chapters and all checkpoints.

The user can navigate to any chapter or checkpoint from here.

Blue checkpoints are the completed ones and trophies are added to the profile.

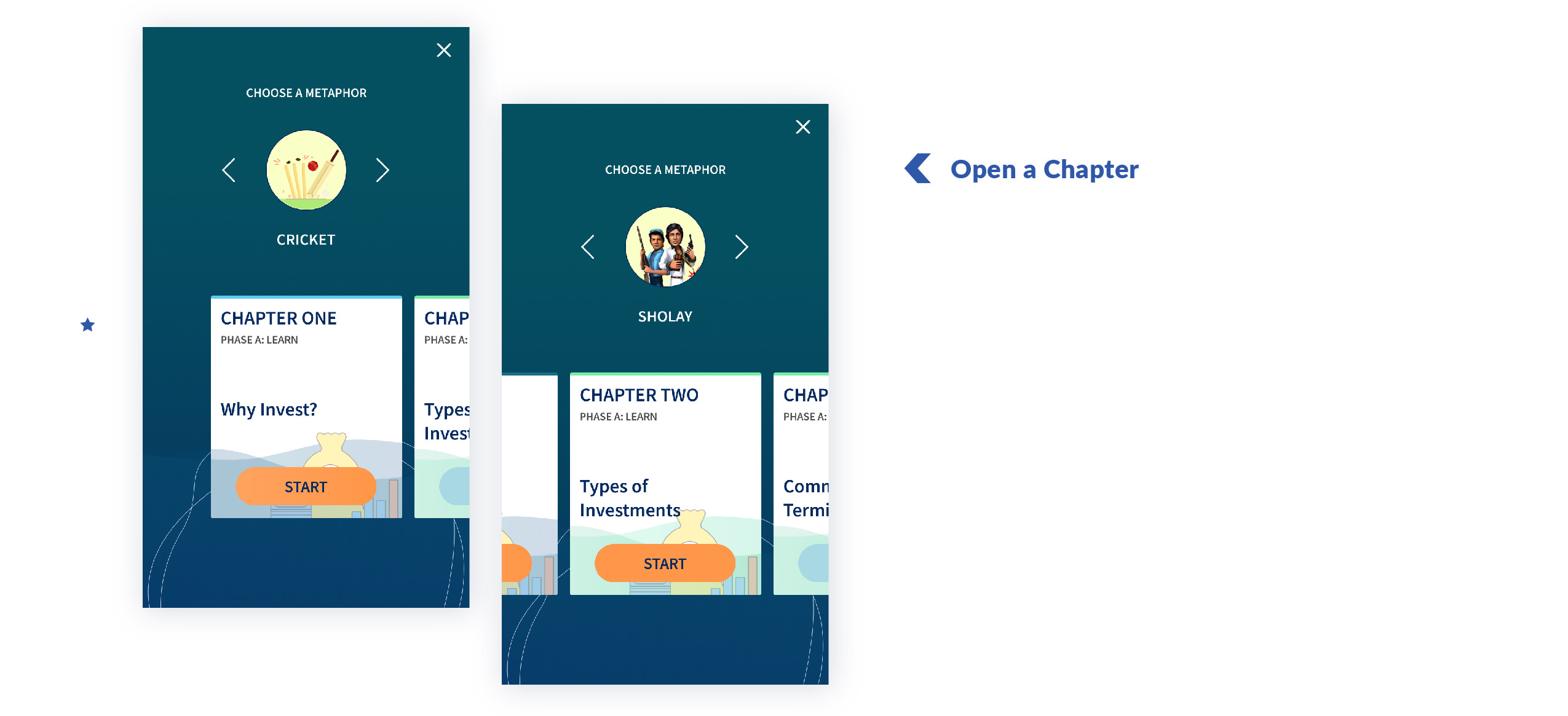

When the user opens a chapter, the screen goes into an immersive mode.

The user can choose any Metaphor here for the chapter s/he wants to take and click on Start.

While a theme is selected at the beginning of a chapter, a Theme Switch icon in chapter mode helps the user change the metaphor at any time during the chapter which basically represents the same card content with the new metaphor.

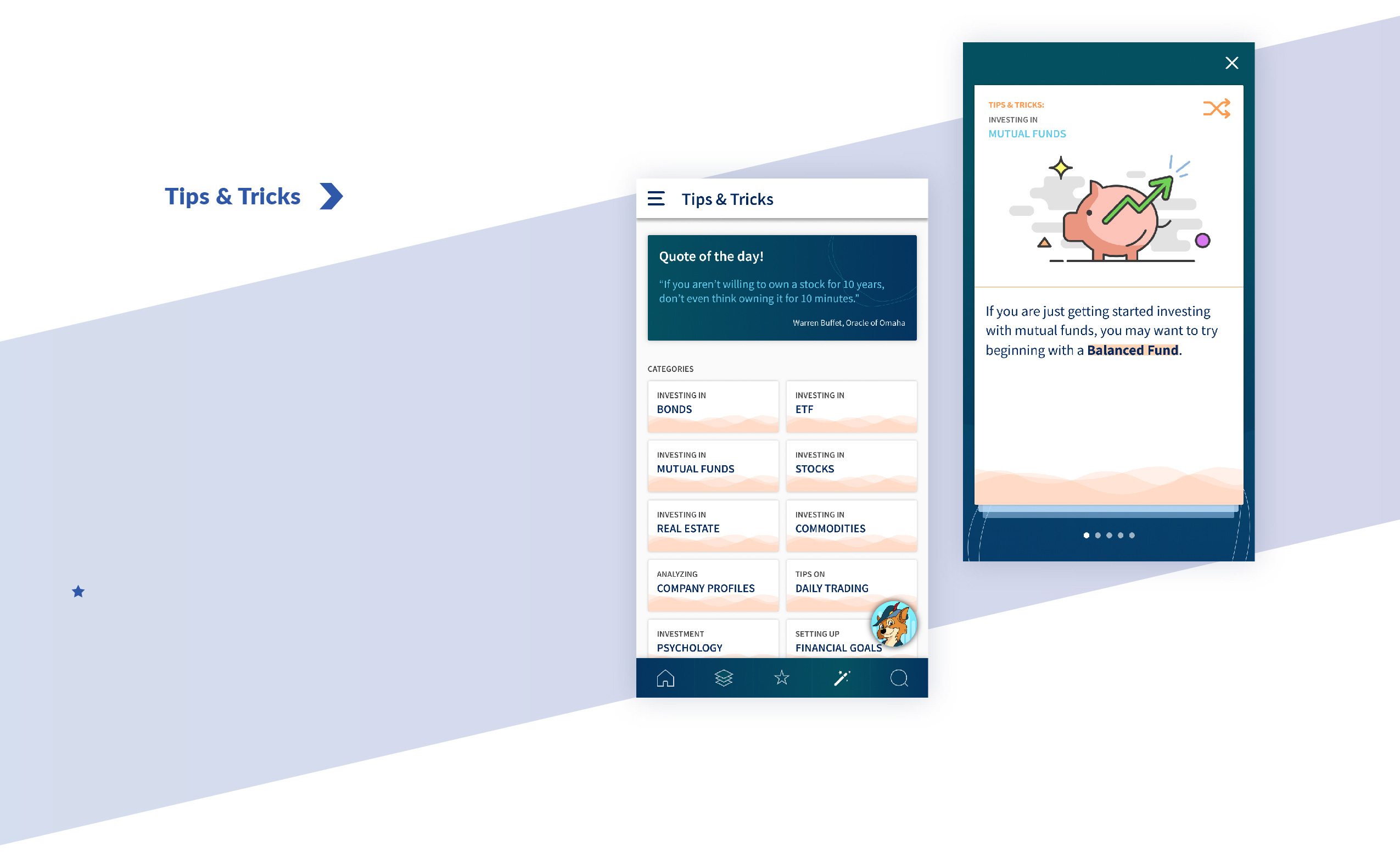

The Tips & Tricks section provides a summary of various tips on investments.

User can tap on any desirable category to see a tip. A Shuffle option helps the user see new Tip Cards.

Tapping on the highlighted text asks help from Robin.

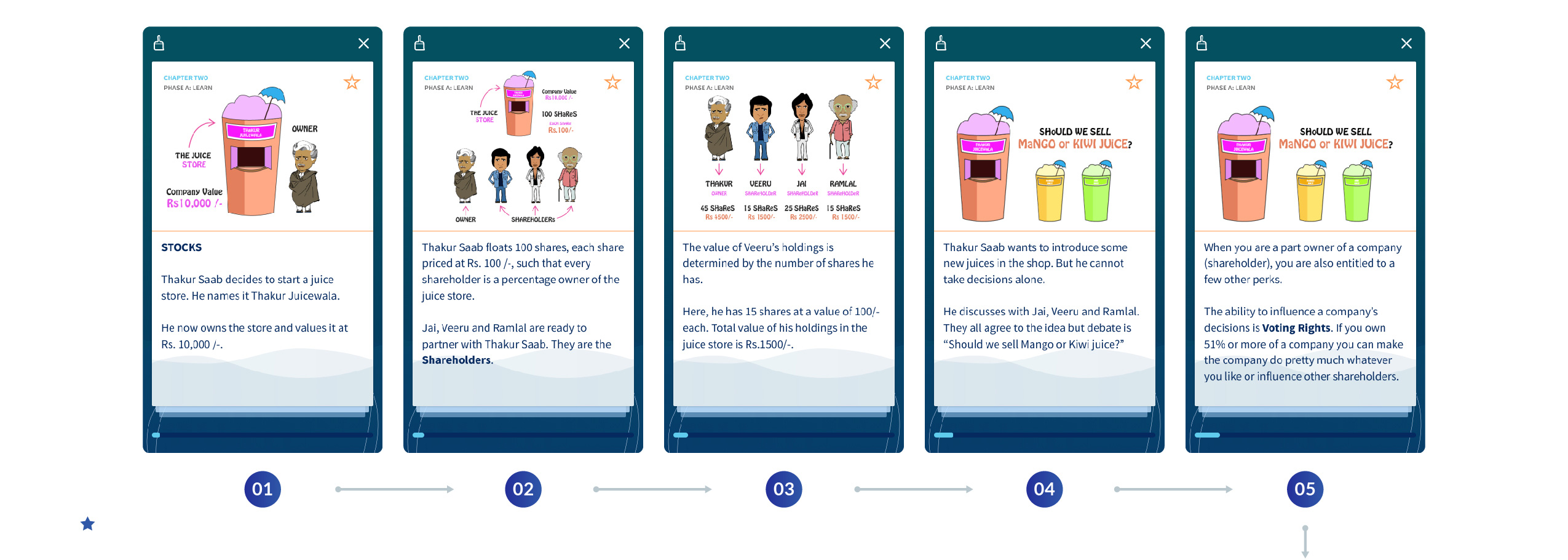

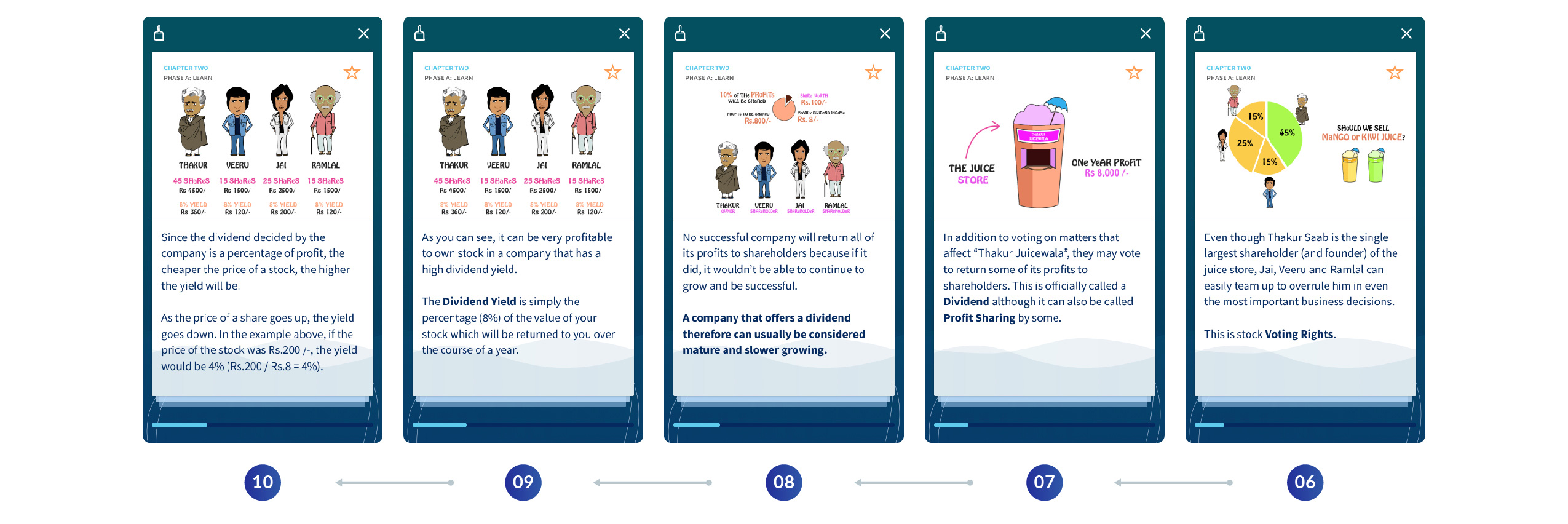

Consider a scenario where Rahul (user) is in CHAPTER TWO – TYPES OF INVESTMENTS and he is trying to understand the basics of STOCKS, basically what is a stock.

He is a big Amitabh Bachchan fan, he loves the movie Sholay and wants to learn stocks by his favourite bollywood characters. He selects METAPHOR as SHOLAY and starts the chapter. Let’s take his journey.

Here, Sholay characters act as Agent Metaphors, which means Thakur, Jai, Veeru, Ramlal and other characters act as volitional elements. Stocks in 10 cards.

Thus, through his favourite Sholay characters Rahul tries to understand the basics of stocks; what is a Stock, who are Shareholders, what are Voting Rights, what is Dividend, and what is Yield, all in 10 cards. Also he learns a few quick tips about investment in stocks.

NOTE: The 4 Sholay character illustrations used above are solely owned by Ishaan Bharat at be.net/osheen. It is used here only for concept representational purpose.

In its present state, this project primarily represents Phase A: LEARN of Vyapyaar, which has been designed and articulated here in the best interest of time, but as an extensive investment education platform, once you are equipped with basic knowledge of investment markets, Vyapyaar needs to scale deeper into next phases of PLAN and GROW whereby investment simulator and a selective learning model will help one take goal oriented, discreet and confident decisions about better investments.

For future expansions, Vyapyaar, presently a simulated learning patform, can upgrade or link to Vyapyaar-PRO, a real-time investment market platform even before GROW phase, such that one can keep growing in the real world of investments.

After 85 odd active hours, on my 5th morning:

• • • • •

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License. © All Rights Reserved 2019.